Hawaii State Department of Education casual hires such as substitute teachers, part-time teachers (PTTs), para-professional teachers (PPTs), and para-professional educators (PPEs) should be eligible for unemployment under significantly expanded unemployment insurance that’s part of the historic $2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act passed by Congress and approved by the president last month.

William Kunstman, a spokesman for Hawaii’s Department of Labor and Industrial Relations confirmed the news to HSTA Friday morning.

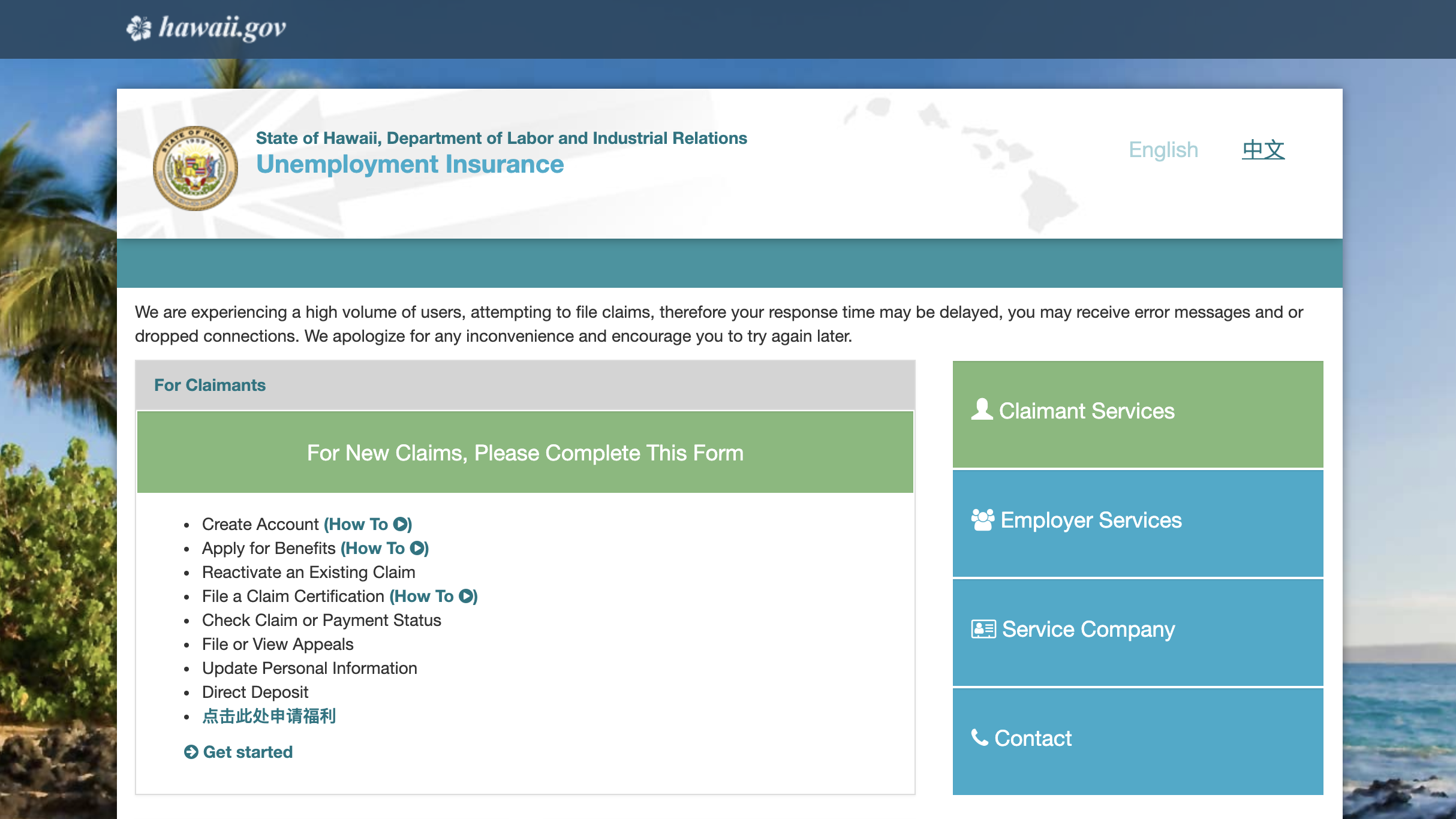

Kunstman says part-time or freelance school employees laid off or unable to get work because of the coronavirus school closures can file an unemployment claim here. You will need to create an account.

For more information, see this COVID-19 labor benefits fact sheet from the state labor department.

In Hawaii, weekly unemployment benefits range from a low of $5 to a high of $658. People out of work because of the crisis, including part-time or casual hire school employees, are also eligible for the $600-per-week Pandemic Unemployment Compensation supplement.

Read this fact sheet released Friday by the National Education Association about unemployment insurance for educators.

While the Hawaii State Teachers Association does not represent most of these part-time and day-hire HIDOE employees, our members work closely with them and we want to support them in their time of need.

HSTA President Corey Rosenlee said, "We are asking our members to reach out to substitute teachers, PTTs, and PPTs who may be affected to make them aware that under these new rules, they may be eligible for unemployment benefits."

The CARES Act allows unemployment benefits for a range of people who weren’t eligible before, including gig economy workers like drivers for Uber or Lyft, freelancers, and independent contractors. Part-time employees who lost their jobs due to coronavirus will also be covered, as will people who had to stop working to take care of a sick member of their family or homeschool their children.

If coronavirus is responsible for your layoff, furlough, or drastic reduction of your hours—or is preventing you from looking for work because fewer employers are hiring—you have a good chance of getting these expanded benefits. It’s worth applying even if you are unsure if you’ll be covered, experts say.

For detailed answers and tips about filing for expanded unemployment during the pandemic, see this article from Vox.

The state will ask for some basic information during the unemployment application process, including:

- Your name, birthday and Social Security number,

- Your last employer’s information, including company name, supervisor’s name, address, and phone number,

- The last date you worked and the reason you are no longer working, and

- Your gross earnings in the last week you worked (starting Sunday and ending with your last day on the job).

You may also be asked about the other employers you worked for in the past 18 months, including the employer name, address, dates of employment, gross wages earned, hours worked per week and hourly rate of pay, and the reason you are no longer working.

Keeping documentation about your previous income and wages is key. This information can be found on your W-2s, paystubs, or invoices if you are a freelancer or independent contractor.